The issue of child support is somewhat complicated. However, like many other topics, it can be understood by starting with the basics and learning more about individual sub-topics.

In this article I will discuss the basics of child support in Canada under the Federal Child Support Guidelines. Before starting this discussion I want to clarify that the information contained in this article is not legal advice.

WARNING: The information provided in the articles on this site is not intended to be use as legal advice, and is provided for informational purposes only. Only qualified lawyers can provide legal advice based on the lawyer knowing all of the circumstances of the person seeking advice. It is strongly recommended that all persons obtain legal advice from a qualified lawyer in their jurisdiction to help them determine their rights and responsibilities in relation to the receipt or payment of child support.

With that important advice out of the way, let’s begin.

Child Support in Canada is calculated under the Federal Child Support Guidelines. These Guidelines were passed into law in 1997, in the hopes that it would reduce conflict between parents by making the calculation of child support more predictable.

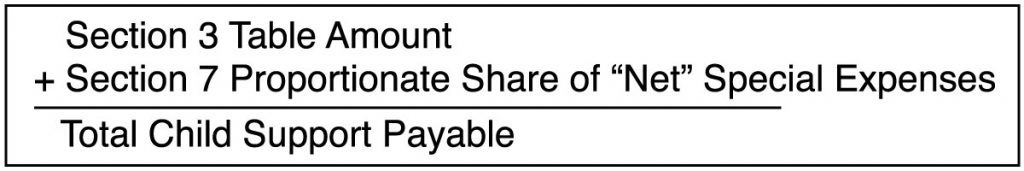

The Federal Child Support Guidelines are actually a Regulation passed under the Divorce Act (Canada). Several Provinces have also passed their own Guidelines, namely, Alberta, Manitoba, and Ontario. Those Provincial Guidelines for the most part are similar to the Federal Guidelines.The total child support payable is generally speaking the total of two different amounts. The “Table Amount” which is calculated under Section 3 of the Guidelines, and a proportionate amount of the “net” Special Expenses a parent has under Section 7 of the Guidelines.

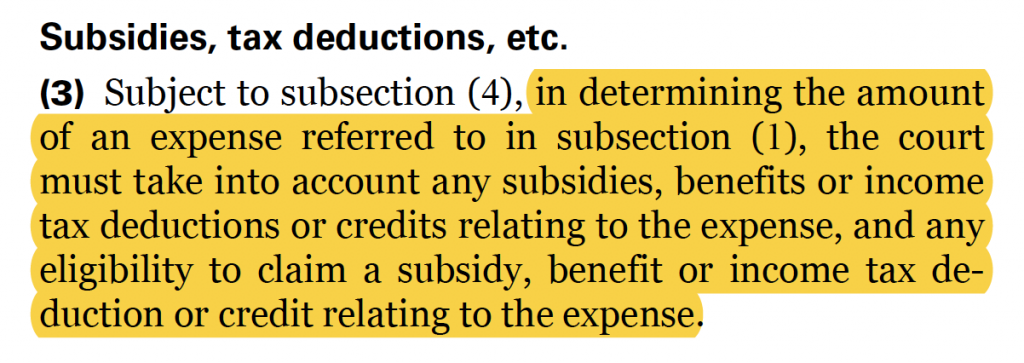

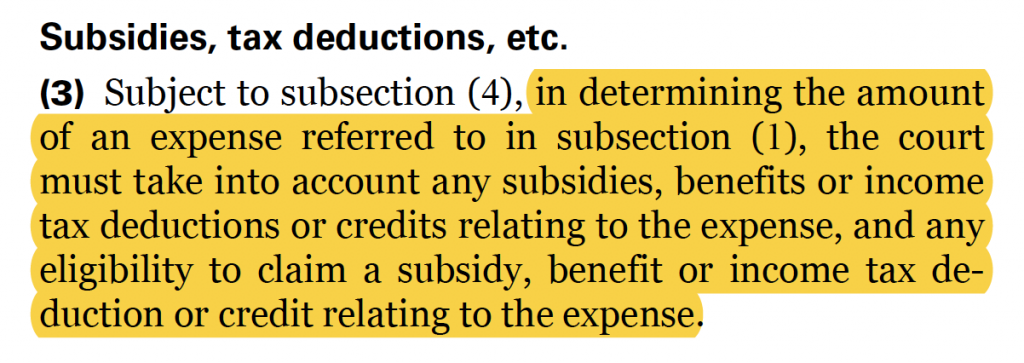

The “net” Special Expenses is the amount remaining after subtracting the tax savings and increased benefits a parent will receive, by claiming Special Expenses on their Tax Return, from the gross costs the parent pays for the expenses. The requirement to subtract these amounts is set out in Section 7(3) of the Guidelines:

Section 3 Table Amount

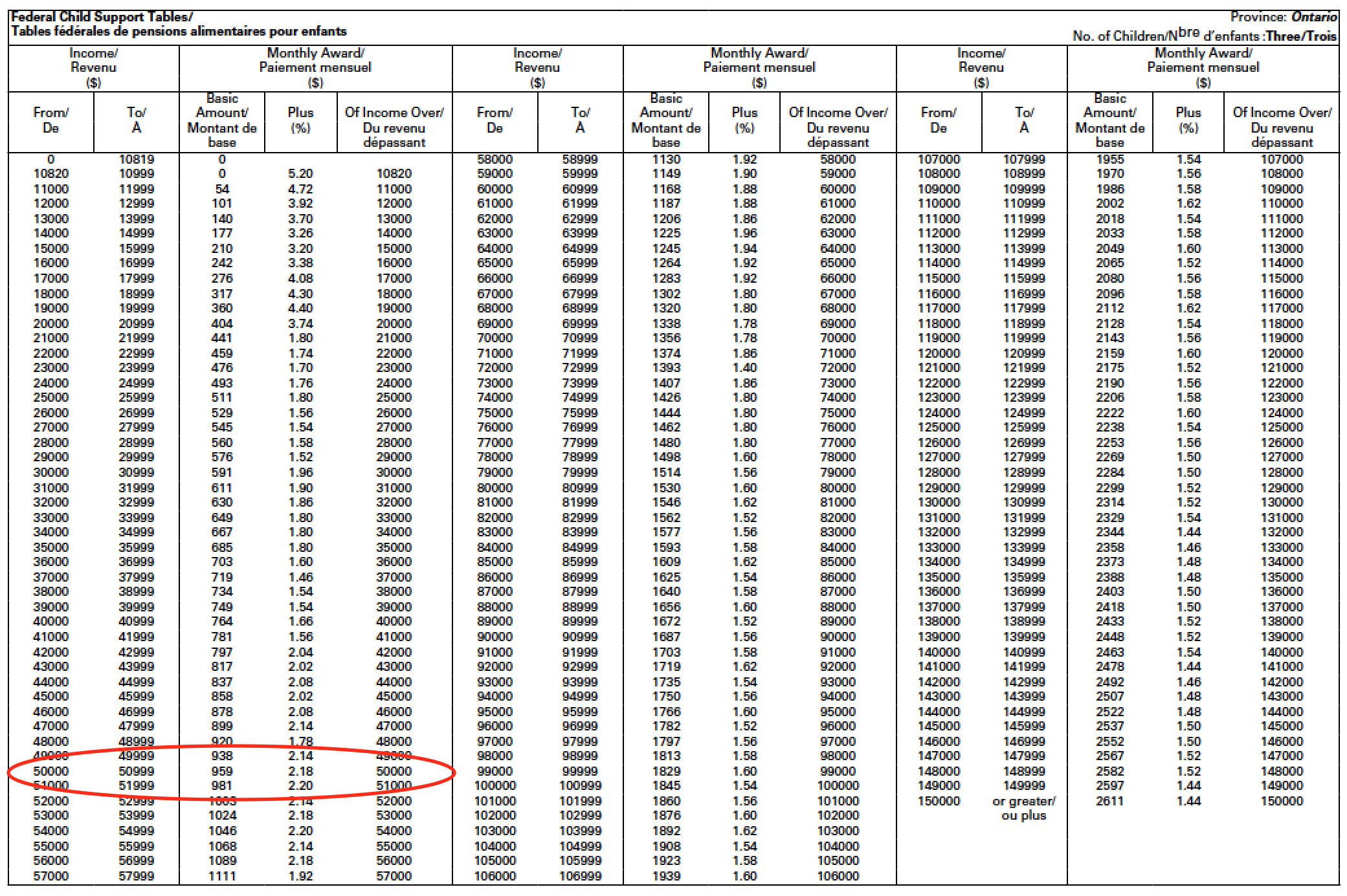

The Table Amount is a calculation based on the payor’s “Guideline Income”, the number of children, and the Province where the payor resides. Each Province and Territory has 6 different Tables, which are applicable based on the number of children the support is calculated for. Here is the Table for 3 children where the payor resides in Ontario.

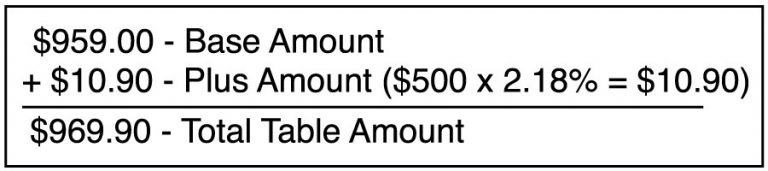

To calculate the amount payable under the Table you start with the “Basic Amount” for the given Guideline Income that falls within the “From” and “To” range, and then you add the additional amount calculated by multiplying the amount over the “Of Income Over” amount by the “Plus %”.

So, for a person with income of $50,500, in Ontario (with 3 children) the amount calculated would be:

While this math seems a little tedious, both iTableAmount and iGuideline do these calculations for you automatically based on the Guideline Income and number of children entered.

There are also numerous web sites which do Table Amount calculations, including the Federal Government’s “Table Look-up” page.

Section 7 Proportionate Share of “Net” Special Expenses

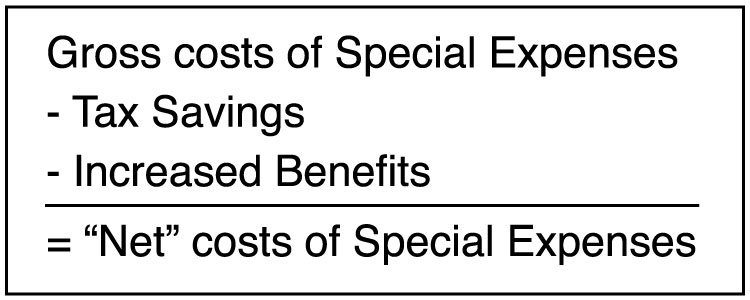

This second amount which makes up the total amount of child support that is payable is much more difficult to calculate because it involves the calculation of the “net” costs of Special Expenses. “Net” means after taking into account the tax savings and increased benefits a parent will receive as a result of claiming Special Expenses (like Child Care) on their Tax Return. These amounts are subtracted from the gross costs of Special Expenses, which gives one the “net” costs of expenses.

The requirement to take into account these amounts is set out in Section 7(3) of the Guidelines which states:

The starting point to doing the calculation is determining what expenses are allowable under Section 7 of the Guidelines.

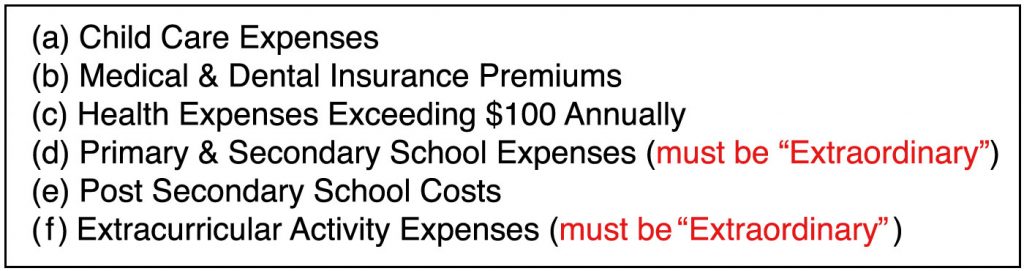

There are 6 different types of Special Expenses, that being:

A Court may allow these types of expenses after taking into account the necessity of the expense in relation to the child’s best interests and the reasonableness of the expense in relation to the means of the spouses and those of the child and to the family’s spending pattern prior to the separation.

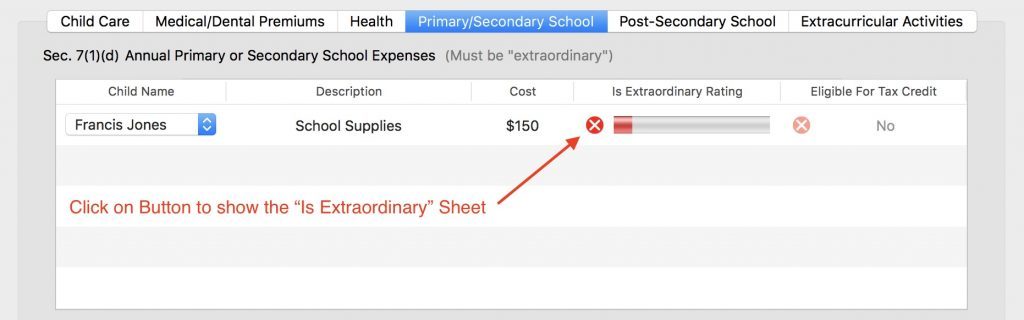

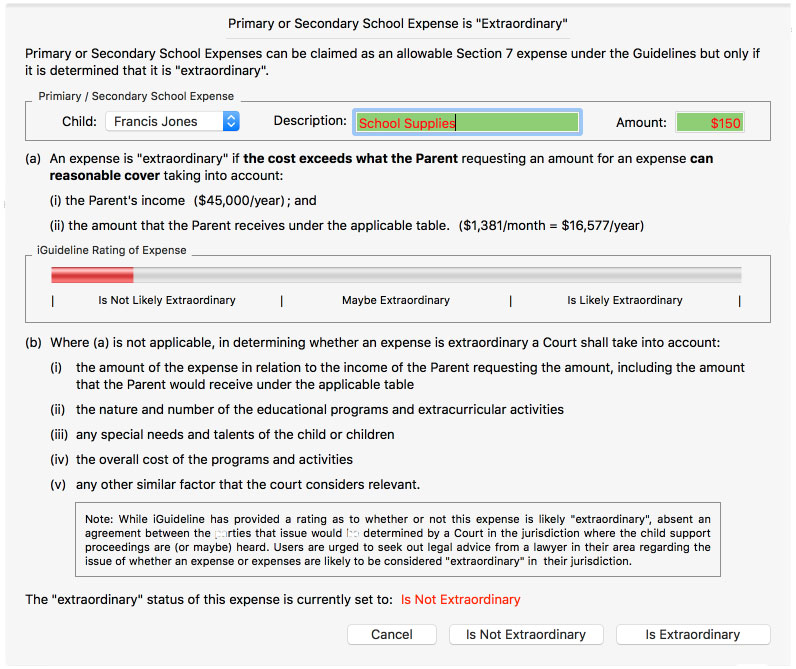

In addition to those considerations, Primary & Secondary School expenses, and expenses for Extracurricular Activities must by “Extraordinary”. Section 7(1.1) of the Child Support Guidelines sets out what “extraordinary” means. iGuideline has an “Is Extraordinary Rating” feature to provide some guidance in considering whether one of these types of expenses is extraordinary with the rating being shown in the table where the expenses are listed:

Clicking on the Button in “Is Extraordinary Rating” column will display the sheet that shows the criteria set out in Section 7(1.1) of the Guidelines. As an enhanced feature iGuideline also shows the Parents Income and the amount the Parent receives under the applicable table:

Once the Section 7 Expenses are determined, the next step is to calculate what the “net” costs are, which again, is done by determining the tax savings and increased benefits a parent will receive as a result of claiming the expenses:

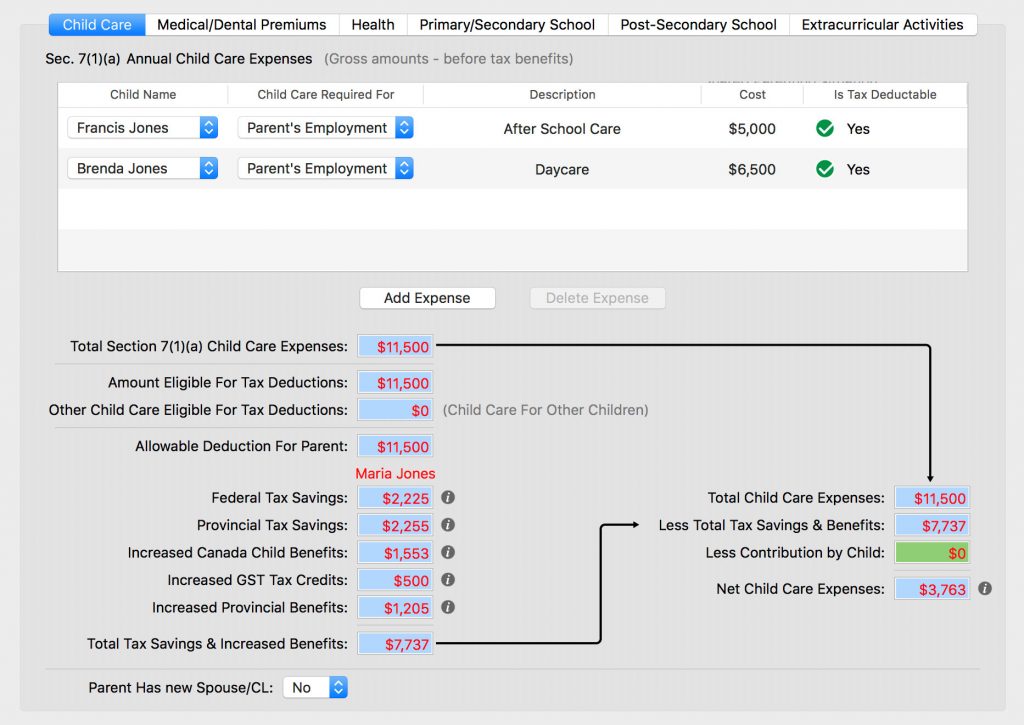

While the formula is simple, the actual calculation of the tax savings and increased benefits is very involved because a persons Federal and Provincial taxes, as well as the different Benefits they will receive, have to be calculated with and without the Special Expenses. Once those values are determined, the differences becomes the Tax Savings and Increased Benefits, which get subtracted from the gross amounts which forms the “net” amount.

These calculations would take hours to do, but again iGuideline does all those calculations instantly based on the income, Province, and other information entered for the Parent. The difference between the gross costs of expense and the “net” costs can be significant depending upon the Parent’s circumstances. Below is a screen shot from iGuideline showing the calculation of the net costs of Child Care Expenses under Section 7(a) of the Guidelines, with particulars of the tax savings and increased benefits:

In this example the gross costs were $11,500, but the “net” costs are only $3,763.

Once the “net” costs of the allowable Special Expenses are known, they are then allocated between the Parents on a proportional basis based on their respective Guideline Incomes as determined under the Guidelines.

That concludes this article. I hope you have found the information helpful. To experience iGuideline yourself, you can download the App for free from the Mac App Store and create a Sample File to start exploring iGuideline’s powerful features. When you decide you want to do your own calculation you can make an In-App Purchase for as little as $19.99 which allows you to do your own calculation.