This is definitely the case when it comes to online child support calculators.

In this article I will show how using a “free” online child support calculator can end up costing a parent thousands of dollars a year in excessive child support payments.

Before starting this discussion I want to clarify that the information contained in this article is not legal advice.

WARNING: The information provided in the articles on this site is not intended to be use as legal advice, and is provided for informational purposes only. Only qualified lawyers can provide legal advice based on the lawyer knowing all of the circumstances of the person seeking advice. It is strongly recommended that all persons obtain legal advice from a qualified lawyer in their jurisdiction to help them determine their rights and responsibilities in relation to the receipt or payment of child support.

With that important advice out of the way, let’s begin.

The calculation of Child Support when a parent has “Special Expenses” (like child care) is extremely complicated because it is not the gross costs of these expenses that gets apportioned between parents, but rather it’s the “net” costs of the expenses after taking into account the tax savings and increased benefits that a parent will receive when they claim the expenses on their Tax Return.

This was covered in the Child Support Basics article on this site. If you are not familiar with the basics of how child support is calculated in Canada, you may want to read that article.

The problem with “free” online child support calculators is that they don’t calculate the “net” amount of Special Expenses, but rather they simply apportion the gross amount of Special Expenses between the parents, and as a result a parent who relies upon that type of calculation can end up paying thousands of dollars a year in child support over the actual amount they should be paying.

To illustrate this I will do a calculation using a “free” online calculator and then iGuideline.

Example (Michael and Jessica)

This calculation will involve a fictional couple in Ontario named Michael and Jessica, who have the following circumstances:

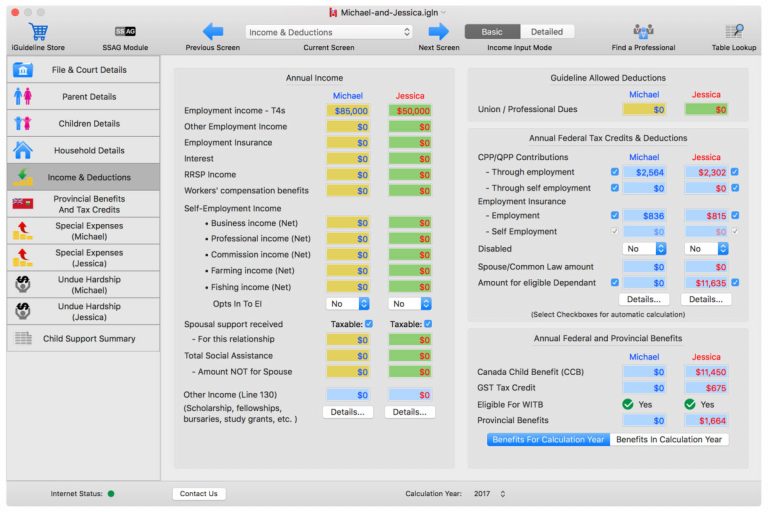

- Michael has employment income of $85,000 per year

- Jessica has employment income of $50,000 per year

- They both Reside in Ontario

- They have two children: Jackson, aged 4, and Emma, aged

- The children reside with Jessica more than 60% of the time.

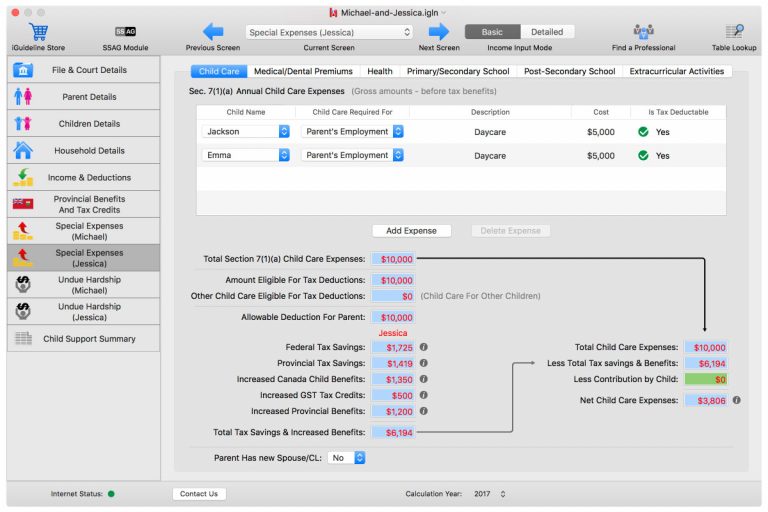

- Jessica pays child care expenses of $5,000 per year each for both Jackson and Emma (so $10,000 in total), which is paid to a Daycare and is tax deductible.

“Free” Online Calculator

For the “free” online calculator we will use one that I found from a Google Search that had a 5 star rating:

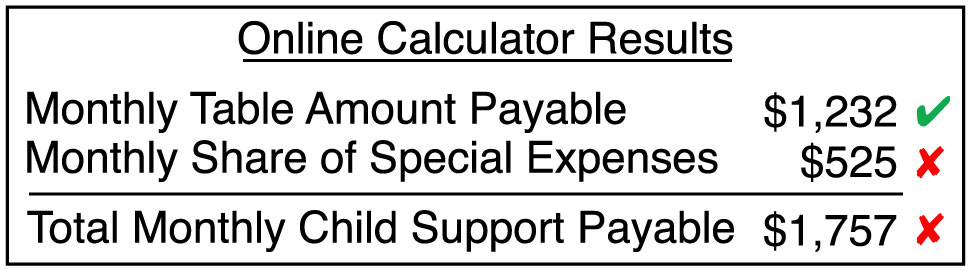

That online calculator has the user enter information for “You”, which in this case will be Michael, and for the “Spouse”, which will be Jessica. After entering the information about the parents, the children, and the child care expenses ($10,000 in total), you click on the “Calculate Support” button, and the following result is shown:

The “Child Support” number of $1,232 is the correct Table Amount Michael would pay to Jessica, but there is a serious problem with the apportionment of the “Special Expenses”.

The result divides the gross amount of these expenses between the spouses, with $3,704/year being apportioned to Jessica and $6,296/year being apportioned to Michael. It is clear that these numbers are gross numbers because they both add up to $10,000 ($3,704 + $6,296 = $10,000).

There is no mention of the tax savings and increased Benefits that Jessica will be entitled to as a result of claiming these child care costs, and nor is there a calculation of what those numbers are, and most importantly the subtraction of those amounts from the gross cost of the expenses to get the “net” costs of the expenses.

As a result, the monthly amount that would be paid by Michael for the child care costs would be $525 per month ($6,296 ÷ 12 = $524.66 -> rounded to $525), with the resulting total monthly child support amount payable by Michael (using these numbers) being $1,757 per month ($1,232 Table Amount + $525 for child care = $1,757).

As we will see below, that would be an over payment of $325 per month, or $3,900 a year.

iGuideine

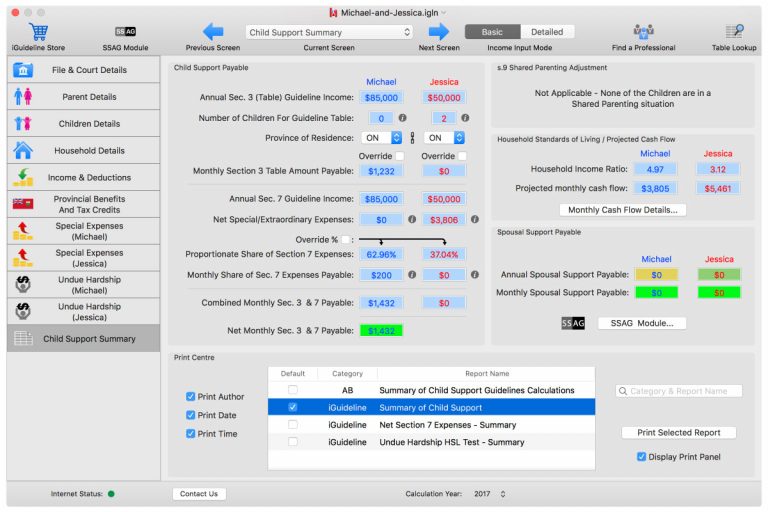

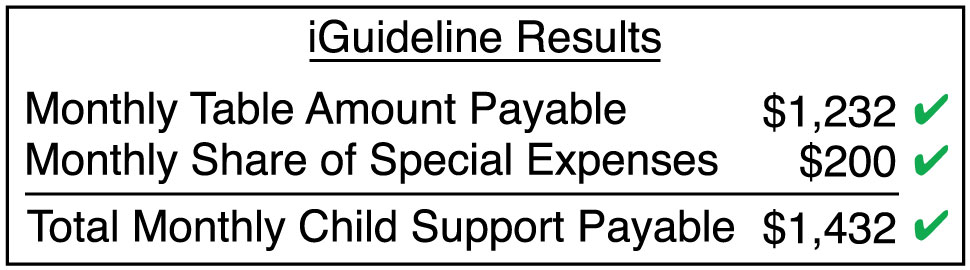

Next we enter that same information into iGuideline, which takes less then 5 minutes, and the following result is shown in the Summary View:

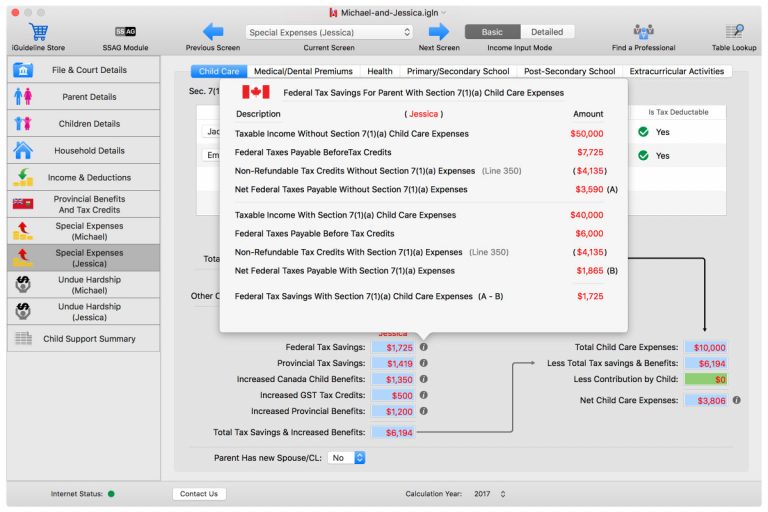

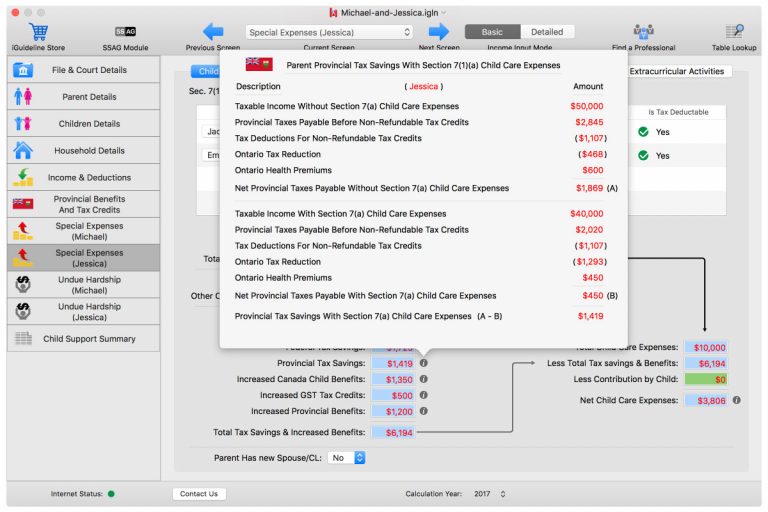

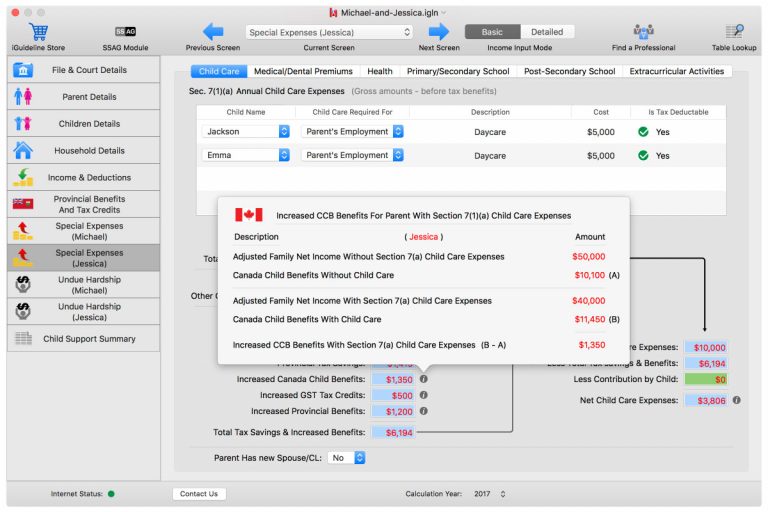

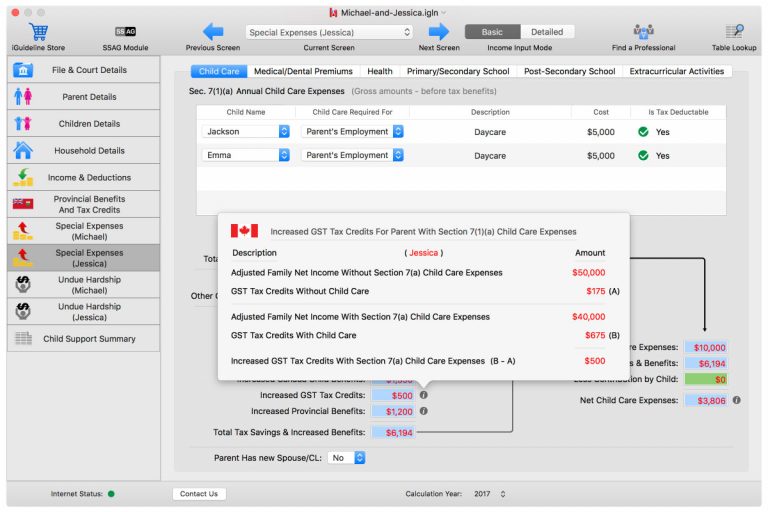

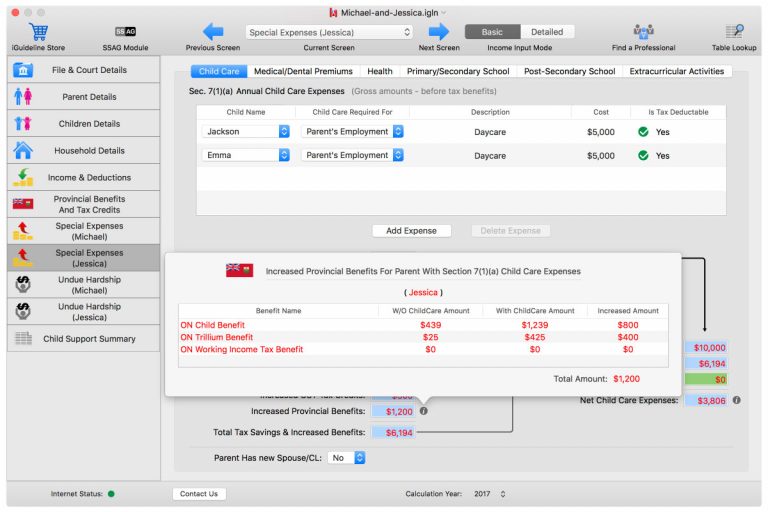

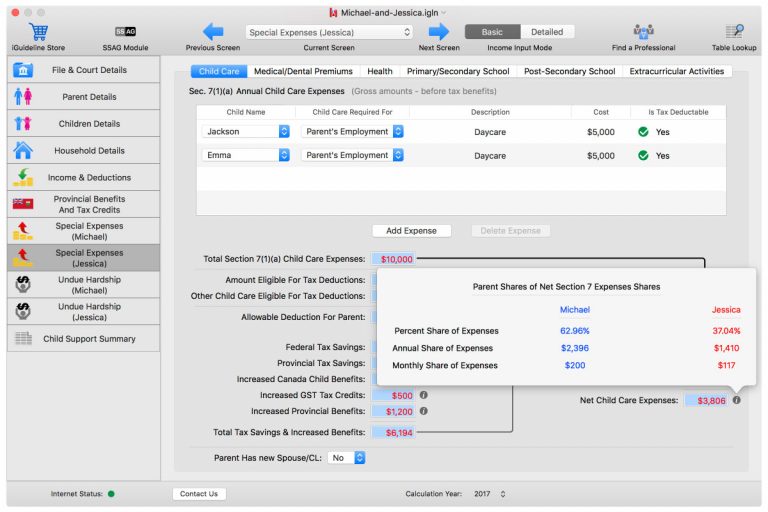

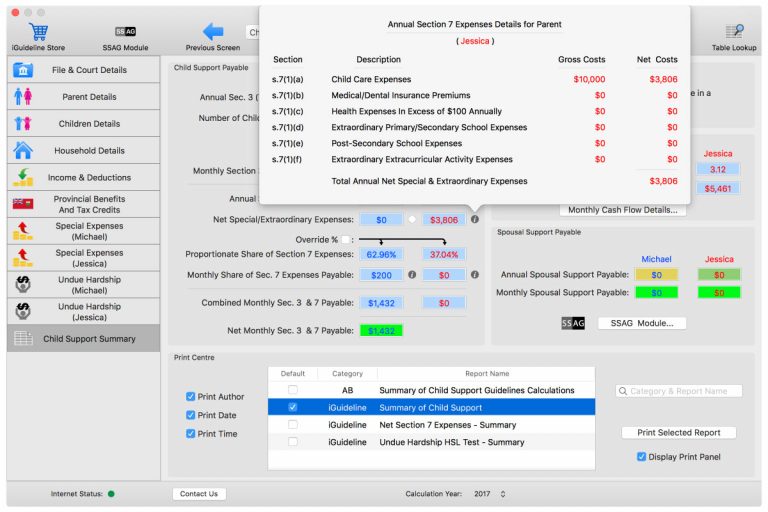

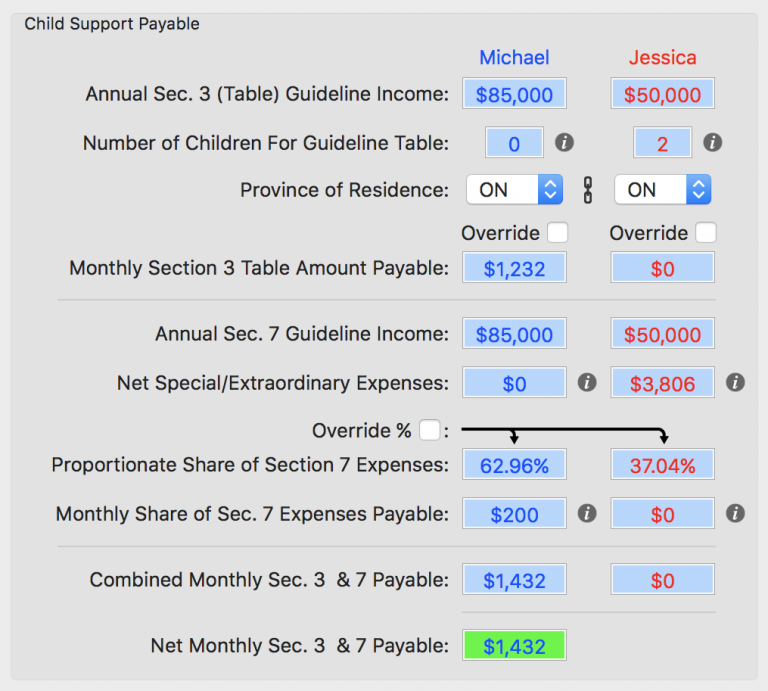

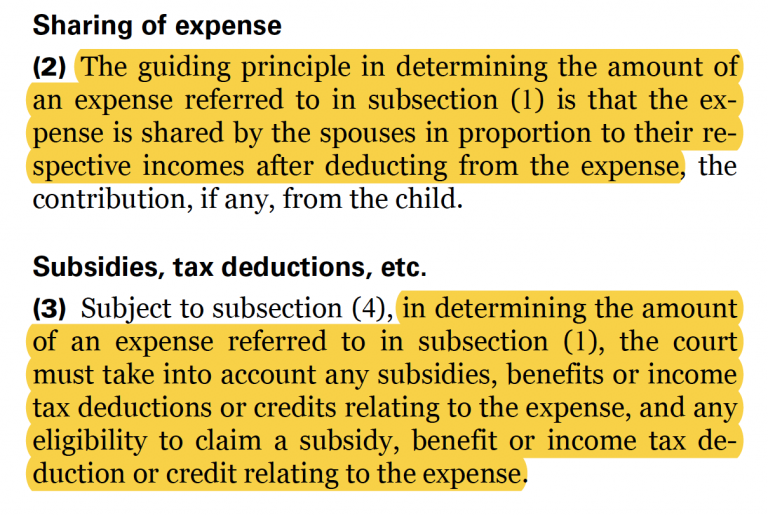

The “Monthly Section 3 Table Amount Payable” is $1,232, which of course is correct, but importantly iGuideline has done the calculations and determined that the “net” costs of the child care expenses, after taking into account the tax savings and increased Benefits Jessica will receive after claiming these expenses on her tax return, is only $3,806 per year. It is this amount that is apportioned between Michael and Jessica in accordance with Section 7(2) and (3) of the Federal Child Support Guidelines:

In this result the correct monthly amount that would be paid by Michael, as his proportionate share of the child care costs, is $200 per month ($3,806 x 62.96% = $2,396.26 ÷ 12 = $199.69 -> rounded to $200), with the resulting total monthly child support amount payable by Michael being $1,432 per month ($1,232 Table Amount + $200 child care = $1,432).

If Michael had relied upon the “free” online calculator to calculate the child support he paid to Jessica he would have over paid by $3,900 each year. ($325 per month x 12 = $3,900)

iGuideline not only does the correct calculation, but iGuideline also shows users the particulars of the tax savings and increased Benefits, as well as details of how those numbers were calculated. Below is a gallery of screen shots from iGuideline showing those amounts in this particular scenario:

As we can see from this example, “free” sometimes can cost a person a lot more then they ever imagined. I guess that’s why there’s the old adage “you get what you pay for”.

To experience iGuideline yourself, you can download the App for free from the Mac App Store and create a Sample File to start exploring iGuideline’s many features.

When you decide you want to do your own calculation you can make an In-App Purchase which allows you to do your own calculation for as little as $19.99.